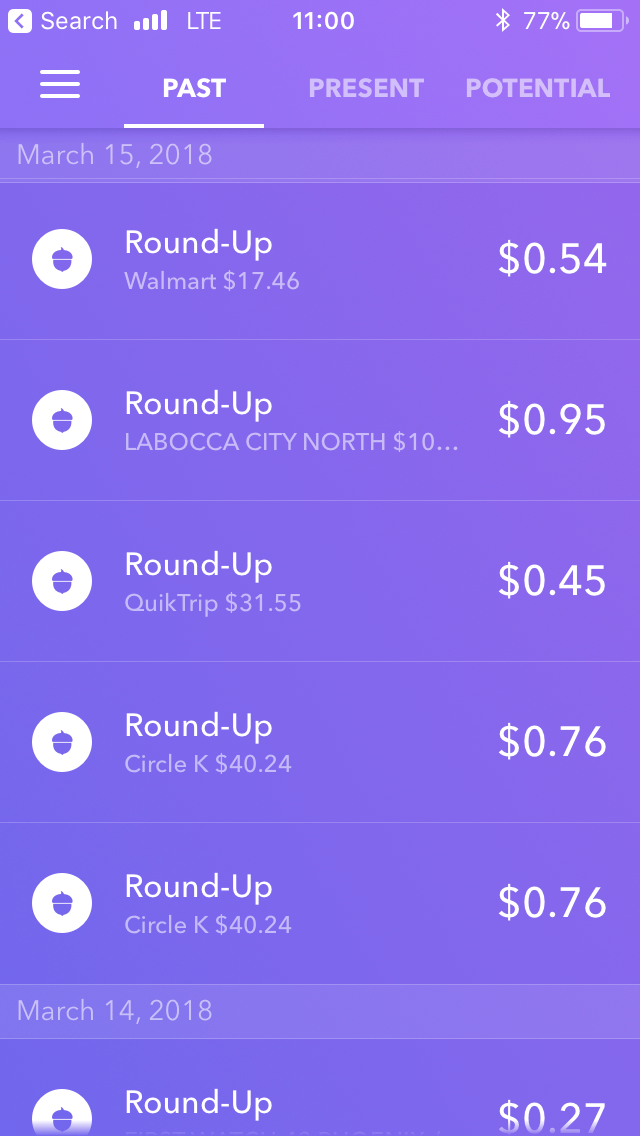

Whenever you make a purchase with the card linked to your Acorns account (or with your Acorns Visa debit card), Acorns will automatically round up your purchase to the nearest dollar and invest the difference. Round-Ups is a fancy name for spare change investing. The real magic happens with the Round-Ups and Acorns Invest features. However, those features are not the backbone of the app.

#ACORN INVESTING REVIEWS HOW TO#

How to use Acorns to improve your financesĪcorns has many unique features that have been developed over the years, such as checking account services and retirement accounts. Now that you know the basics of how Acorns works, let’s discuss how you can actually use Acorns to improve your financial life. These algorithms are highly intelligent and have gotten smarter over the years. Instead, a robo-advisor is a complex computer algorithm that uses specific data to make investment decisions for you. However, don’t think of actual robots sitting behind computers investing your money. This was the original idea that popularized Acorns.Īnd the term robo-advisor, what does that mean? A robo-advisor is exactly what it sounds like. In other words, rounding up your purchases to the nearest dollar and investing the difference. It’s very common to see the term micro-investing being used when describing spare change investing. This type of investing used to only be reserved for people with fat wallets. Micro-investing allows you to start investing in major indexes like the S&P 500 with as little as $1 or even less. The term has gained popularity because of apps like Acorns. Micro-investing simply means investing small amounts of money. How Acorns works The basicsĪcorns is a micro-investing and robo-advisor service that makes investing your money easy. The app is highly praised for its intuitive features and remarkably easy interface. Since then, it has expanded its features to include FDIC insured checking account services, retirement IRA products, and more.Īcorns has over 814,000 reviews on the App Store, and Google Play combined with a total rating of 4.7 out of 5 stars. We always recommend our readers to go through the detailed app reviews of the top-notch mobile app before downloading it.Acorns is a financial services app that specializes in micro-investing and robo-investing.Īcorns has over 4.5 million users and over $1.2 billion in assets under management.Īcorns was founded in 2012 and originally only offered the spare change investing feature. Acorns provide 256-bit encryption security to the users, so there is no concern about the safety of the money. That's not much for managing your spare changes to turn it into a profitable investment. Acorns charge only $1 monthly for the accounts investing up to $5,000. When you feel like you have enough money from the investment you can withdraw it anytime without any trouble.

Learn from the experts via magazines and articles.Spent little as $5 a day and make $2,000 in a year.Use your spare change to invest smartly.The magazines and articles will help you in grow and making smart investment decisions.

#ACORN INVESTING REVIEWS PROFESSIONAL#

Along with this, you can also get the professional advice and knowledge with the business magazines provided by the app. The accounts with the Acorns are SIPC protected up to $500,000 which makes your money protected against any fraud. You can also keep a regular eye on your profile and check the progress from anywhere. While investing you will get the several options in Acorns app like Recurring investment, one time investments, Found money, and Referrals. Whenever you make the transaction the Acorns app will automatically invest the spare changes into the diversified portfolio of ETFs of over 7,000 stocks and bonds. The users can invest a little as much $5 in the bonds and stocks without thinking much. The idea is quite smart for the users who regularly shop and spent money to painlessly save money.

0 kommentar(er)

0 kommentar(er)